Google Adsense Ads

অনার্স ৩য় বর্ষের ম্যানেজমেন্ট অ্যাকাউন্টিং সাজেশন 2025

| জাতীয় বিশ্ববিদ্যালয় অনার্স পাস এবং সার্টিফিকেট কোর্স ৩য় বর্ষের BA, BSS, BBA & BSC অনার্স ৩য় বর্ষের [২০১৩-১৪ এর সিলেবাস অনুযায়ী] ম্যানেজমেন্ট অ্যাকাউন্টিং (Management Accounting) সুপার সাজেশন Department of : Accounting & Other Department Subject Code: 232507 |

| 2025 এর অনার্স ৩য় বর্ষের ১০০% কমন সাজেশন |

ম্যানেজমেন্ট অ্যাকাউন্টিং অনার্স ৩য় বর্ষ সাজেশন, চূড়ান্ত সাজেশন অনার্স ৩য় বর্ষের ম্যানেজমেন্ট অ্যাকাউন্টিং, অনার্স ৩য় বর্ষের ম্যানেজমেন্ট অ্যাকাউন্টিং ব্যতিক্রম সাজেশন pdf, অনার্স ৩য় বর্ষের ১০০% কমন ম্যানেজমেন্ট অ্যাকাউন্টিং সাজেশন

অনার্স ৩য় বর্ষের পরীক্ষার সাজেশন 2025 (PDF) লিংক

সর্বশেষ সংশোধিত ও সাজেশন টি আপডেটের করা হয়েছে 2025

ম্যানেজমেন্ট অ্যাকাউন্টিং অনার্স ৩য় বর্ষ সাজেশন 2025

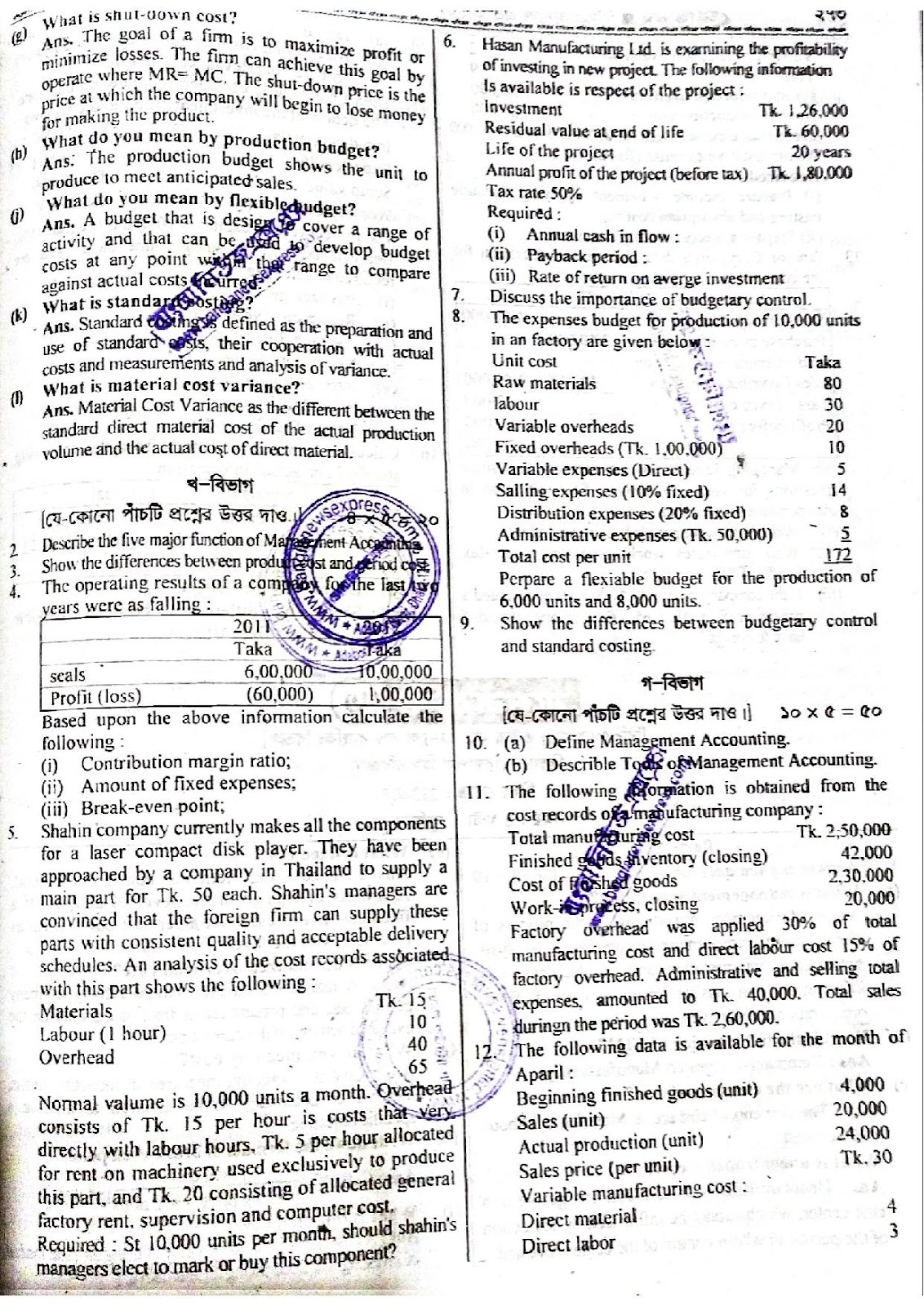

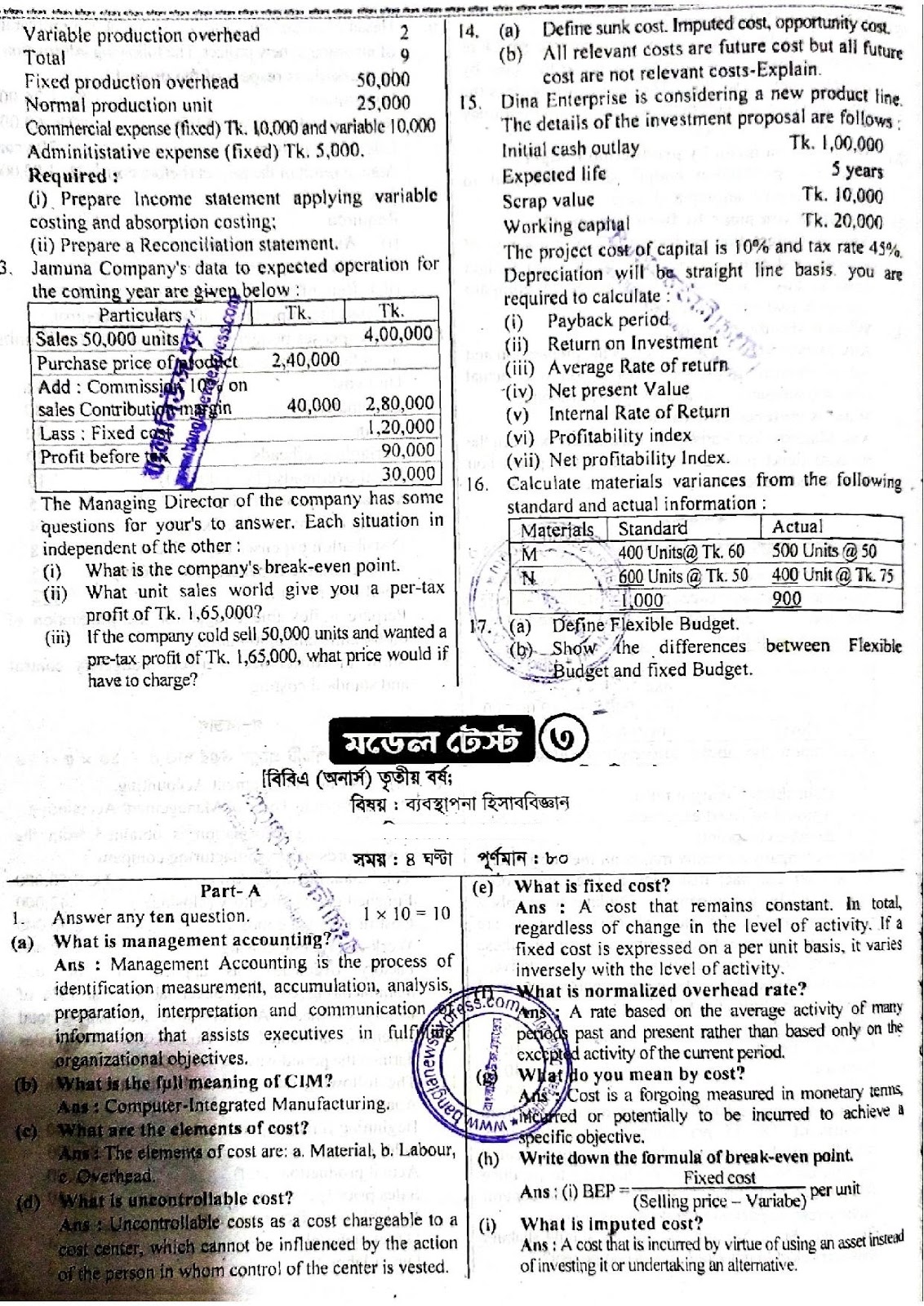

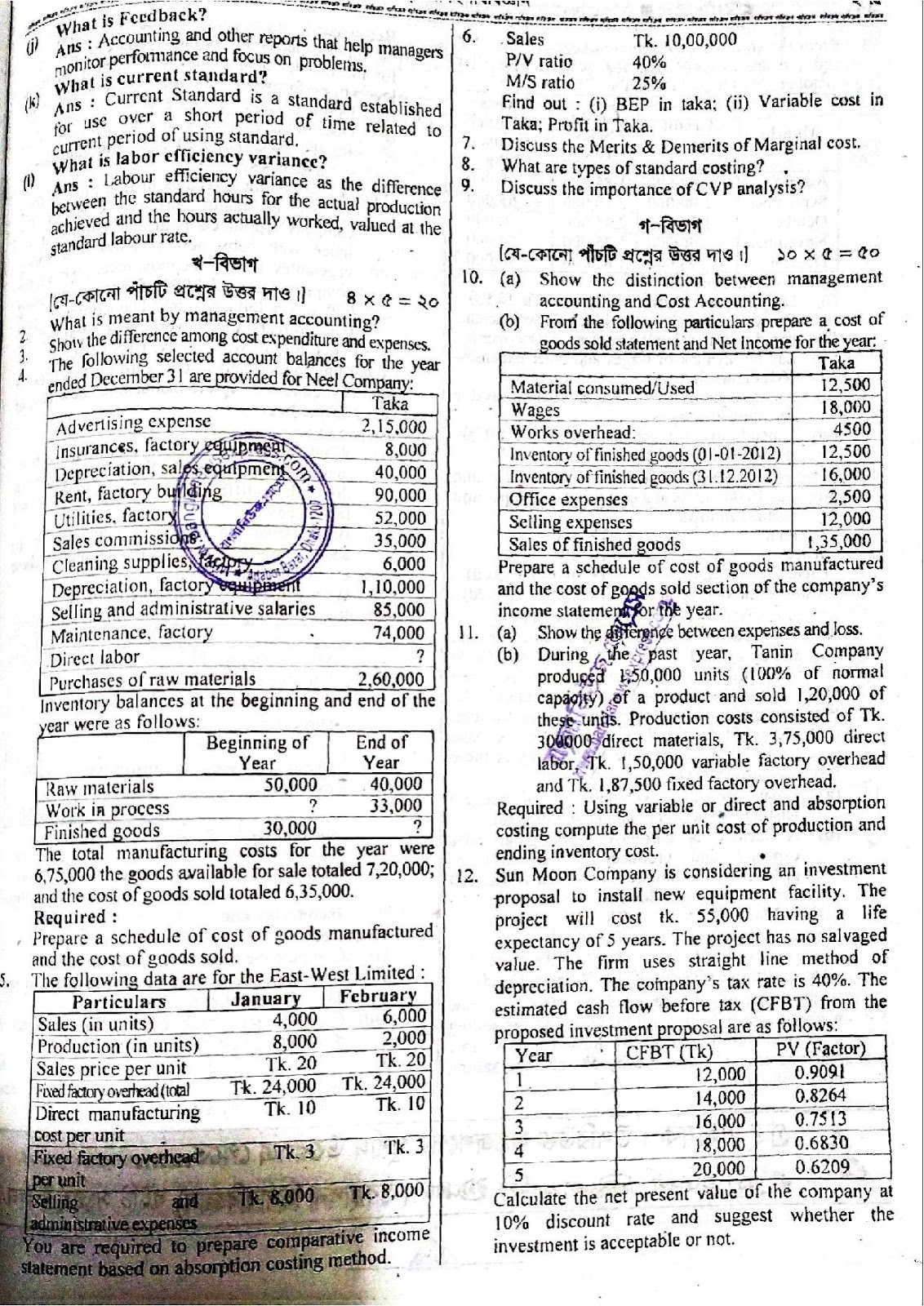

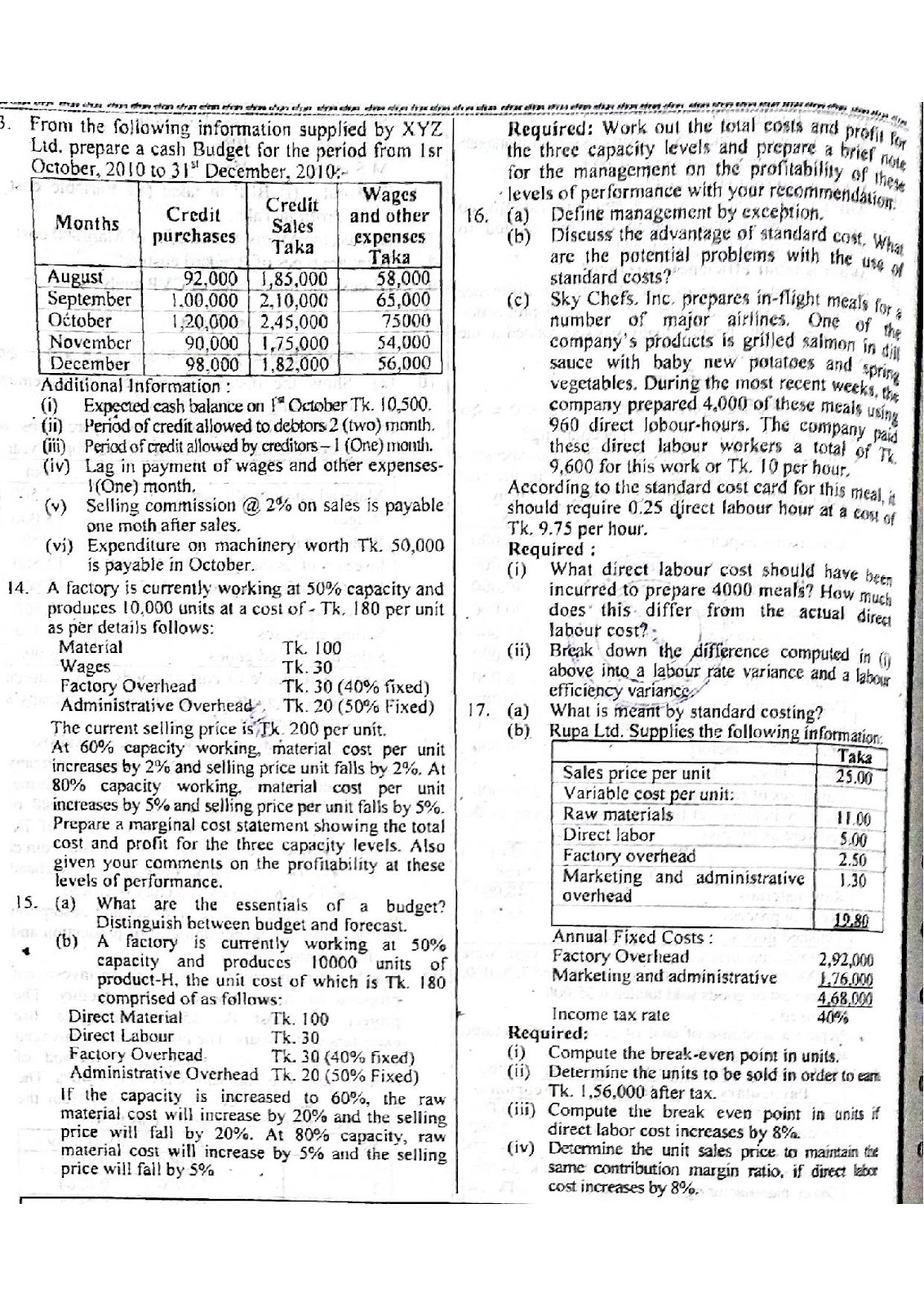

ক-বিভাগ: অতিসংক্ষিপ্ত প্রশ্ন ও উত্তর

1. What is the full meaning of AICPA?

Ans. The full meaning of AICPA is American 1 Institute of Certified Accountants.

2. What is management accounting?

Ans. Management Accounting is the system of 1 identification measurement, Accumulation, analysis, preparation, interpretation and communication of information that co-operate managers in fulfilling organizational target or mission.

3. What in the full meaning of GAAP?

Ans. The elaboration of GAAP is, “Generally Accepted Accounting Principles.”

4. Define cost.

Ans. Cost is a forgoing measured in monetary terms, incurred or potentially to be incurred to achieve a specific objective.

5. What is semi-variable cost?

Ans. Semi-variable costs are costs which posses characteristics of both fixed and variable overhead costs.

6. What is product cost?

Ans. All kinds of costs that are involved in the purchase or manufacture of goods are called product cost.

7. What is capital rationing?

Ans. The Capital Rationing refers to the choice of investment offers under financial constraints in terms of a given size of capital.

8. What is JIT?

Ans. Just in time (JIT) inventory control systems occur when a business holds no stock and instead relies upon deliveries to raw materials and components arrive exactly when they are needed.

9. What is inventoriable cost?

Ans. All costs that are involved in the purchase of manufacture of goods. In the case of manufacturing goods, these costs structure of direct materials, direct labour and manufacturing overhead costs used in the production process.

10. What is traceable fixed cost?

Ans. A cost that can be identified with a particular segments and that arises because of the existence of that segment is called traceable fixed cost.

11. What is activity cost pool?

Ans. Cost pools is an accounting term that refers to groups of accounts seving to express the cost of goods sold service alocatable with in a business.

12. What is unavoidable cost?

Ans. Unavoidable cost that cannot be influenced at the business unit level but is controllable at the corporate level.

13. What is markup?

Ans. Mark up is an amount by which price overcome cost.

14. What is break even point?

Ans. Break even point is the level of activity at which an organization neither earns a profit not incurs a loss.

15. Write down the formula of contribution margin ratio.

Ans. Contribution margin ratio…

=(Total Contribution margin/Total Sales)×100.

16. What is high low method?

Ans. It is a mathematical method that uses the total costs incurred at the high and low levels of activity to classify mixed costs into fixed and variable components.

17. What is break-even chart?

Ans. When the relationship between revenue, cost and level of activity in an organization presented in graphic form is called break-even-chart.

18. What do you mean by range?

Ans. Difference between highest and lowest value is called range.

19. What is marginal cost?

Ans. Marginal cost are variable costs consisting of labour and material costs, plus an estimated portion of fixed costs is called Marginal cost.

20. What is shutdown cost?

Ans. The cost that can not be avoided by storing the production is called shutdown cost.

21. What is flexible budget?

Ans. A budget which is designed to change in accordance with the level of activity actually attained is called flexible budget.

22. What is IRR?

Ans. IRR method is an alternative mathod of NPV. The rate at which the NPV is zero. Thus it does not involve any assumptions about interest rate.

23. What is cash budget?

Ans. Cash budget is a plan indicating expected cash inflows (receipts) and outflows disbursements) during the specific period of time.

24. What is zero based budget?

Ans. A technique of budgeting where in a manager is required to prepare the budget for his area of activities from base i.e. from zero.

25. What is financial Budget?

Ans. A financial budget must assess financing 1 needs, including an evaluation of potential cash shortages. Financial budget deals with the expected assets liabilities and stockholders.

26. What is budgetary control?

Ans: The budgetary control is techniques, planing and control method and acting upon results to achieve maximam profitable.

27. What is budget variance?

Ans. A measure of the difference between the actual fixed overhead costs incurred during the period and budgeted fixed overhead costs as contained in the flexible budget.

28. What is NPV?

Ans. NPV is the summation capital investmentsusually earn return that extends over fairly long period of time.

29. What do you mean by variance analysis?

Ans. According to CIMA “Variance analysis is a process of determining variance and causes of it’s”.

30. What is idle time variance?

Ans. It is that portion of labour efficiency variance which is due to abnormal circumstances such as strike, lock-outs, power failures, machine breakdown material crises etc, is called Idel time variance.

সূত্র: courstika

| Honors Suggestion Links | প্রশ্ন সমাধান সমূহ |

| Degree Suggestion Links | BCS Exan Solution |

| HSC Suggestion Links | 2016 – 2025 জব পরীক্ষার প্রশ্ন উত্তর |

| SSC Suggestion Links | বিষয় ভিত্তিক জব পরিক্ষার সাজেশন |

ম্যানেজমেন্ট অ্যাকাউন্টিং অনার্স ৩য় বর্ষ সুপার সাজেশন PDF Download 2025

খ-বিভাগ: সংক্ষিপ্ত প্রশ্ন

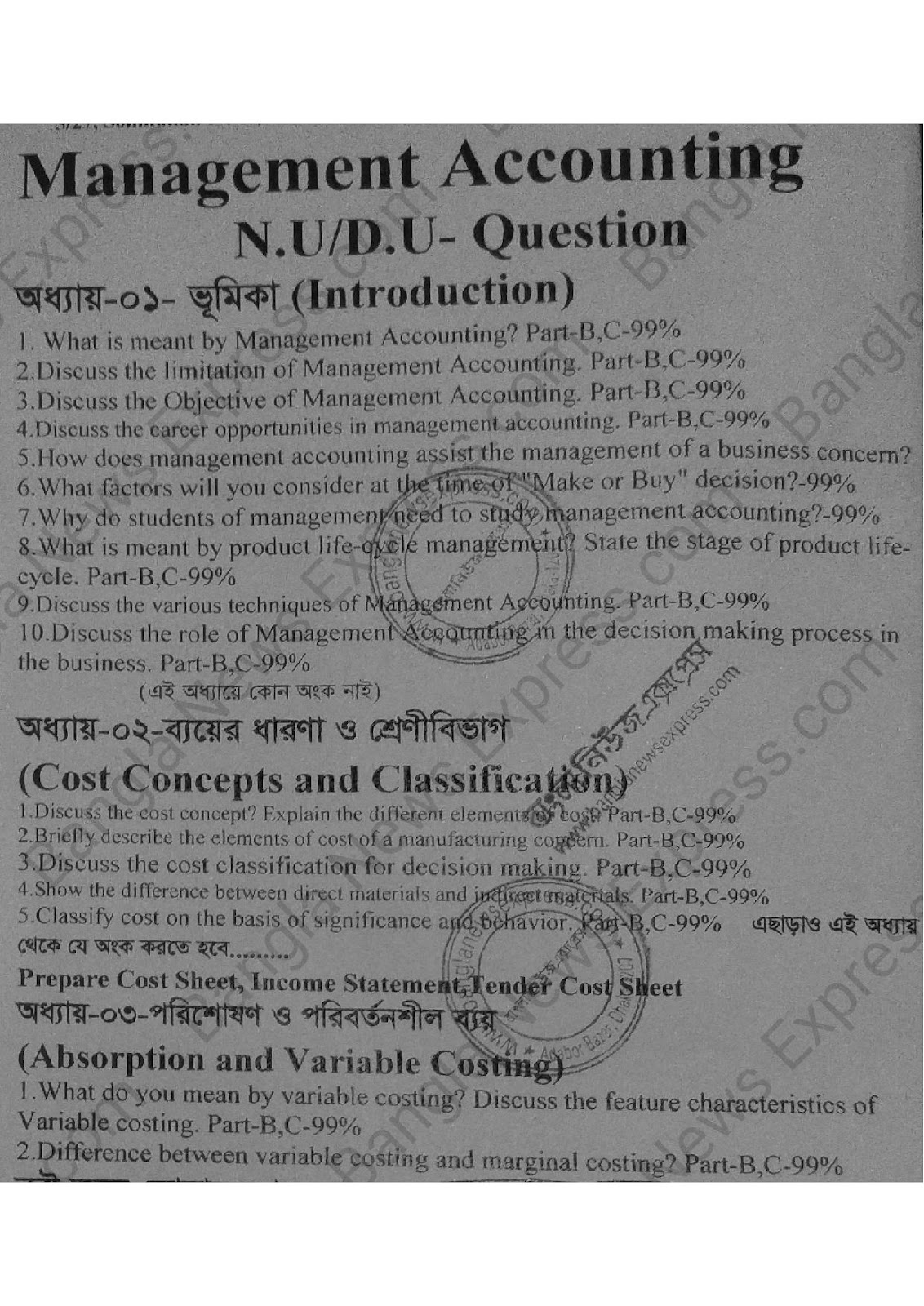

1. What is meant by Management Accounting?

2. Discuss the different stage of the product Life cycle.

3. Describe the role of management accounting in the decision making process in a business organization.

4. Discuss the career opportunities in management accounting.

5. Discuss the Product Cost and Period Cost.

6. Show the differences between variable costing and h absorption costing.

7. Distingush between Traditional Costing and activity based costing.

8. State the underlying assumptions of CVP analysis.

9. What are the procedures of different decision making by susing incremental cost analysis?

10. Distinguish between budget and standard.

11. a. Discuss the advantages of Standard Costing.

b. What are the potential problems with the use of standard costs?

12. a. What is meant by product life-cycle management? State the stage of product life-cycle.

b. Define value chain. Name the six primary business functions that make up the value chain.

13. Discuss the method of standard costing.

14. The following information is obtained from the cost record of ABC manufacturing company:

Total manufacturing cost

Closing inventories of finished goods

Cost of finished goods

Work-in-progress closing

Factory overhead was applied 30% of total manufacturing cost and direct labour cost was 15% of factory overhead. Administrative and selling expenses Tk. 45,000. Total sales during the period was Tk. 3,10,000.

Prepare a cost sheet from the above information.

PDF Download ম্যানেজমেন্ট অ্যাকাউন্টিং অনার্স ৩য় বর্ষ সুপার সাজেশন 2025

[ বি:দ্র:এই সাজেশন যে কোন সময় পরিবতনশীল ১০০% কমন পেতে পরিক্ষার আগের রাতে সাইডে চেক করুন এই লিংক সব সময় আপডেট করা হয় ]

Google Adsense Ads

[ বি:দ্র: উত্তর দাতা: রাকিব হোসেন সজল ©সর্বস্বত্ব সংরক্ষিত (বাংলা নিউজ এক্সপ্রেস)]

Part A

What do you mean by GAAP

What is Management audit

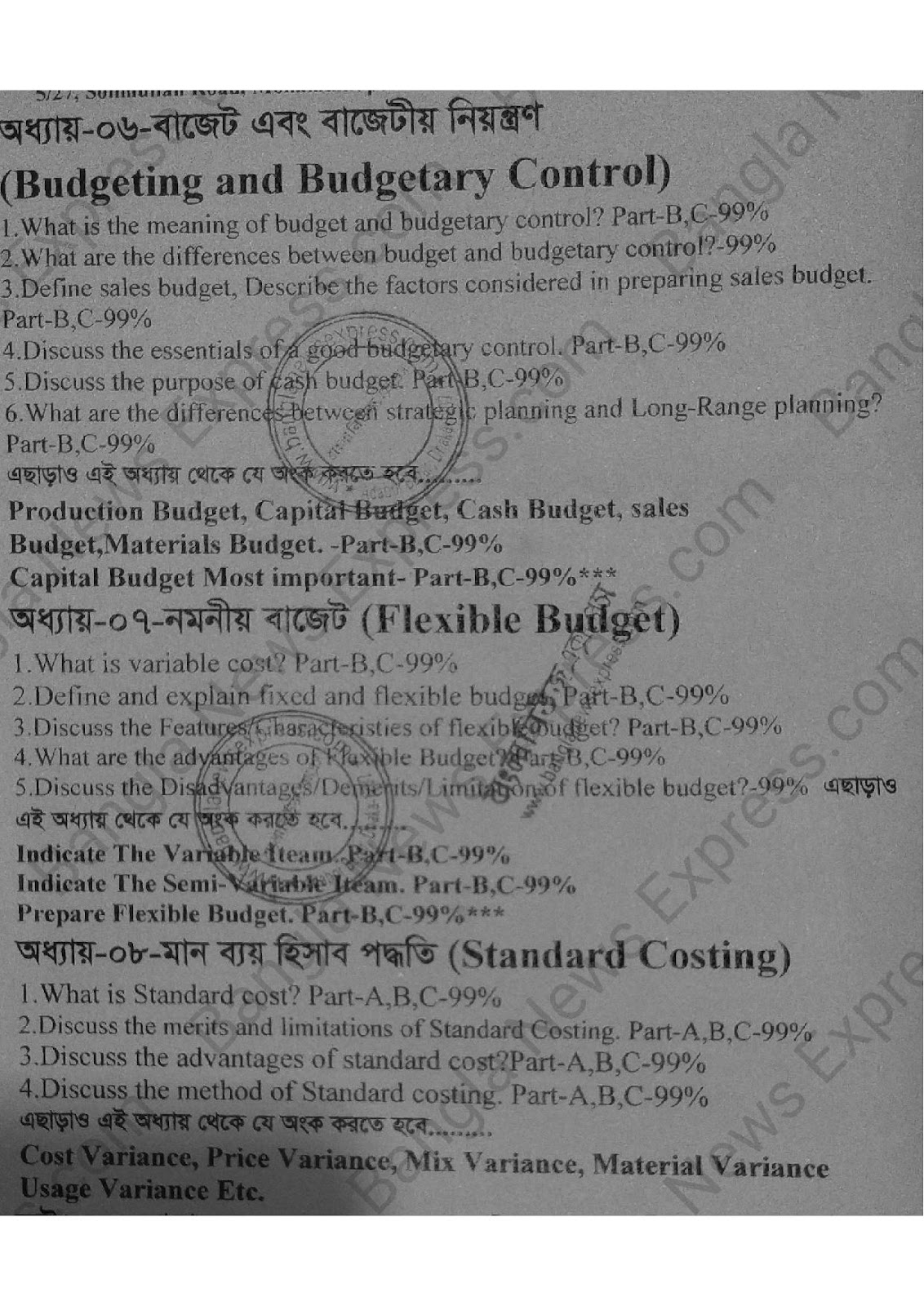

What is budget

what is benchmarkung

what is sunk cost

Elaborate IFIC

Elaborate ACCA

Define the prine cost

what is cost statement

what are the elements of cost

what is conversion cost

what is just time inventory system

what is opportunity

what is proforma statement

which costing method is also known as full costing

what is called marginal cost

what is break even point

what is sales forcasting

what is cvp

what is contribution margin

what is marginal cost

what is relevant cost

what is fixed budget

what is cash budget

what is abc costing

what do you ment by felxible budget

Give two examples of semi variable cost.

what is relevant cost

what is standard costing

what do you mean by variance analyics

what do you mean by labour cost variance

what is overhead variance

what do you mean by cost

Part B.

what is meant by product life cycle management

Briefly discuss the importance of management accounting

show the difference between product cost and preiod cost.

show the difference between variable costing and absorption costing

show the comparison of flow of cost between variable costing and absorption costing

How does cost volum.profit analysis help in management decision making

show the difference between fixed cost and variable.

Distinguish between differnational cost & margunal cost

Defintion of relevant and irrelevant cost

All future costs are relevant do you agree?why?

what factors will you consider all the time of make or buy decision

what are the difference between fixed budget and flexible budget

Discuss the method of standard costing

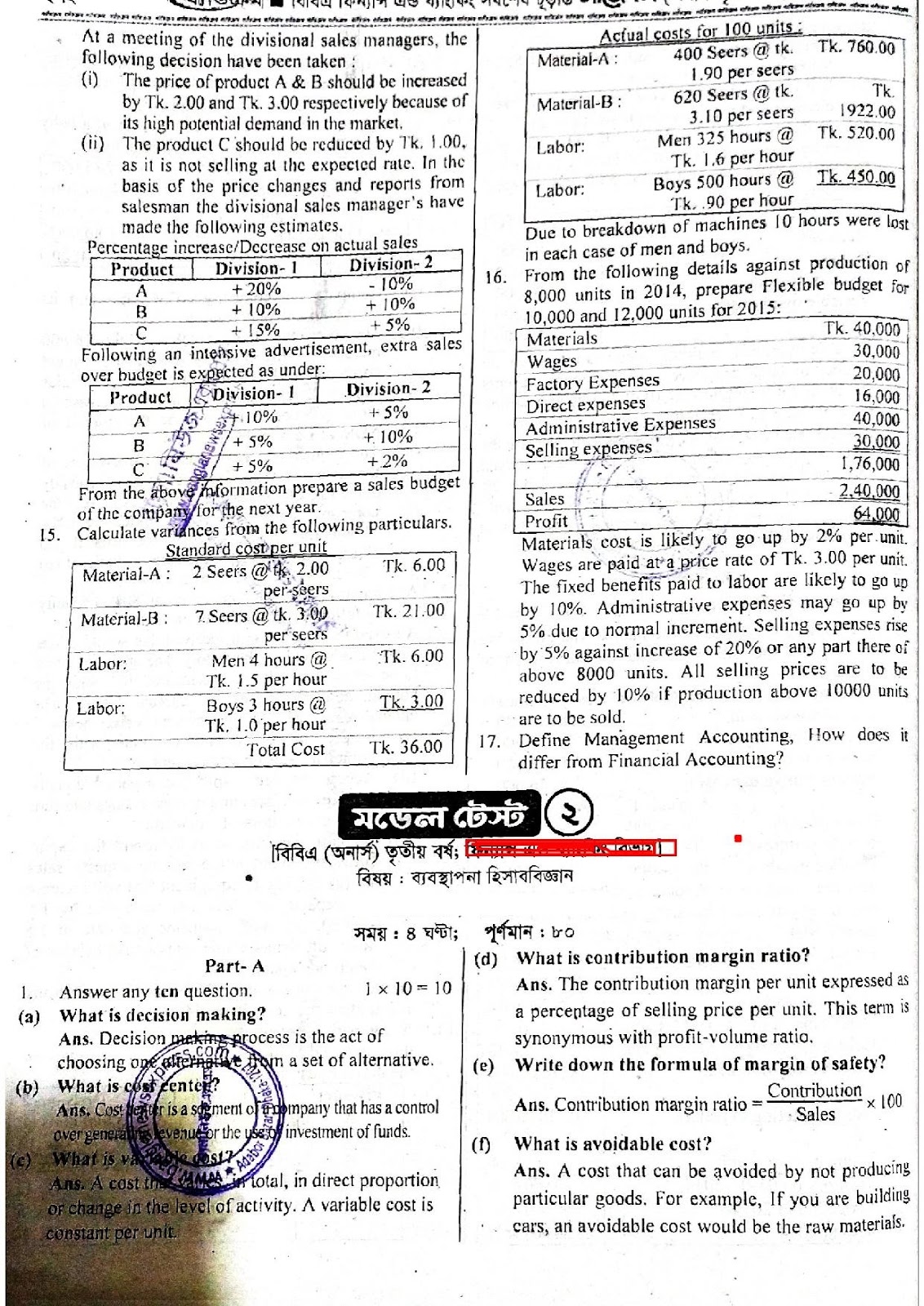

Form the following information prepate a cost sheet nu.16

you have given the following informations of rahaman brothers

Diya enterprisec is considering a new product line. the detalls of the investment propsal are a follows nu bba 14

standard cost producing 100 unit of bucket are given below nu 16

The expense budget for 10.000 units of a product in a factory is as follows nu 15

2025 ম্যানেজমেন্ট অ্যাকাউন্টিং অনার্স ৩য় বর্ষ সাজেশন পিডিএফ ডাউনলোড

part c

Discuss the techniques of management accounting nu 06.10.18

Briefly describe the elements of a cost of a manufacturing concern

variable cost is fixed and fixed cost varible Explain

Discuss the advantages and disadvantages of vpn

standard costing is the tool for effective cortrol of cost explain

a Discuss the Advantages of standard costing

b what are the potential problems with the use of standard cost

The apex company produces different types of leather goods. the sales revenue for the year tk 12.00.000. the cost related different informstions during the year were as follows

A manufacturing company produces bicycles.the company had 260 units of opening inventory cosying tk 700 per unit in 2014

The apex co produces different types of bags the sales revenuev for the year is tk 12.00.000 nu 16

the cost of production related information of rahaman ltd are given beloe nu.17

Dhaka manufacturing company —– nu 17

the following particulars —- nu 17

Scientific ltd produces and sales calculator —- nu 16.18

Form the following information supplied by xyz nu.13

Abc ltd is a nanufacturing concern —– nu 15.18

Ashaan ltd manufactures product a and—– nu 12.18

puspita manufacturing company has the following nu bba 14

Rk ltd is considering an invesment — nu 18

on the basis of standard working level nu 16.17

The budgeted prime cost of a product was as follows.nun17

2025 জাতীয় বিশ্ববিদ্যালয়ের এর 2025 অনার্স ৩য় বর্ষের ম্যানেজমেন্ট অ্যাকাউন্টিং পরীক্ষার সাজেশন, 2025 অনার্স তৃতীয় বর্ষ ম্যানেজমেন্ট অ্যাকাউন্টিং সাজেশন

Honors 3rd year Common Suggestion 2025

আজকের সাজেশান্স: Honors Management Accounting Suggestion 2025,ম্যানেজমেন্ট অ্যাকাউন্টিং চূড়ান্ত সাজেশন 2025

Google Adsense Ads